For many reasons, ensuring appropriate liquidity for your organization is a critical component of being resilient, proving to be more and more imperative when writing this during the COVID-19 pandemic.

Many organizations, by strategy or by luck, are working to increase their cash positions. The Wall Street Journal reported cash held by U.S. public companies is up to $2.54 trillion at June 30th, 2020 from $1.96 trillion at the end of 2019.

Many publicly traded companies across North America appear to be cashing in on the recent stock market rally by issuing shares and other financial instruments to weather the storm.

Why Companies Are Increasing Their Cash Positions

Cash Is Queen!

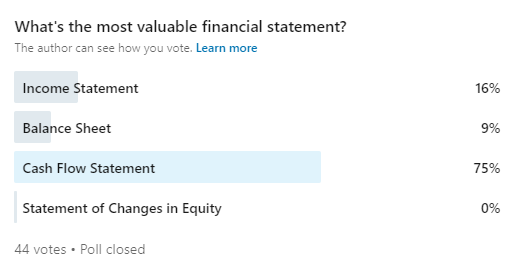

I recently polled my LinkedIn connections to gauge what they thought was the most valuable financial statement, and 75% of respondents answered the cash flow statement.

Investopedia.com defines the Cash Flow Statement as a financial statement that provides aggregate data regarding all cash inflows a company receives from its ongoing operations and external investment sources. It also includes all cash outflows that pay for business activities and investments during a given period.

How To Improve Your Cash Flow Position

Here are 19 ways you can improve your cash flow position.

1. Sell more

It may seem obvious, but the first question I’d ask is can we sell more? Sometimes business 101 lessons are too often forgotten, and driving more sales could improve your cash flow.

2. Increase Price

Is it possible for you to increase the price of your goods and services and remain competitive? Doing so could increase your revenue per transaction and ultimately improve your cash flow.

3. Create a new source of revenue

Are you taking full advantage of your assets to drive optimal revenue levels? Consider putting together a task force or asking your Chief Revenue Officer to present new ideas for ways to drive new sources of revenue that align with the current or future organization’s vision.

4. Reduce the Cost of Goods Sold (COGS)

Can you reduce the cost of goods and services and maintain competitiveness and sales volumes? Are there alternative suppliers, or could you bring some outsourced services in-house for less?

5. Reduce operating expenses

When was the last time you took a real look at your op-ex? Have you recently challenged your top 10 expense items and re-evaluated them to market? Even a small adjustment to some of your highest costs could have significant returns on your cash flow position. The market changes fast, and industries that were once monopolies find themselves ripe with competition almost overnight, which may give you more buying power than previously negotiated.

6. Reduce inventory

Do you have too much inventory on hand? Is the inventory old? It may be worth unloading some things you aren’t likely to sell at a discount to clean up your balance sheet and improve your cash flow.

7. Send invoices immediately.

How quickly are you sending out invoices for services performed? Looking at efficiencies in your cash collections process goes beyond have they paid the invoice. Could start as soon as the time between service completed/product sold and invoice received by the client?

8. Speed up cash collections.

They say measure it to manage it. Work to reduce your key AR KPIs such as Days Sales Outstanding to drive cash flow.

9. Discounts on early payment.

Would your organization benefit from offering discounts on your invoices to get paid faster? Would that be the difference in turning that AR into cash?

10. Slow down the payment of creditors.

Are you paying your bills immediately? Could you pay those net 30 or net 90?

11. Speed up vendor payments

Some of your vendors likely offer favorable terms for early payment, such as 2/30, where you get 2% off if you pay within 30 days. Would taking advantage of these improve your cash flow situation?

12. Lease instead of buy.

When evaluating large capital purchases or investments, does owning these assets make sense? Could you lease them instead?

13. Use Electronic payments (and deposits)

Leverage technology to process your payments and receivables faster. This could help reduce your payables (through the examples listed above) and on receipt of cash cut out the travel time of cheques that could take weeks to arrive and clear when deposited into your corporate banking account. More on how to digitize your invoice process here.

14. Reduce taxes

Higher or lower taxes are topics I’ll leave to the politicians, however ensuring your organization is paying no more than necessary and legal in taxes is prudent and fiscally responsible. Are you confident your organization is paying the right amount of taxes? It might be a good time to check in with your tax department or have an external firm come in and do an assessment.

15. Increase line of credit

Depending on how your organization manages its working capital, there may be an opportunity for you to increase your line of credit with your financial institution, or get a line of credit to improve your cash position.

16. Borrow funds to improve working capital

On top of a line of credit, is your balance sheet leveraged appropriately? Depending on your organization’s risk tolerance and many other considerations, it may be prudent or advantageous to re-consider how much debt your organization is willing to take on. This could help improve your ability to invest in new markets or into research and development without dilution.

17. Factor your invoices

Do you have long-term agreements with your clients? Do your clients demand more favorable payment terms? Depending on whether it makes sense, receiving that cash upfront for an interest fee may help you double down on growth.

18. Issue shares

A ubiquitous form of raising capital is to issue shares to your company. There are many private (and public) companies whose sole purpose is to invest in the business. An equity partner may be right for your business.

19. Leverage data to make decisions

Become a data-driven company and make decisions that drive your KPIs and improve your company’s fiscal health. Read the article here on how to reduce your month-end close so you can stop chasing numbers and start using them!

About Multiview Financial Software

Founded in 1990, Multiview builds powerful financial and operational management applications for companies across a multitude of industries. The organization’s flagship offering, Multiview ERP, is used across client organizations where they benefit from the powerful integrated modules combined with sophisticated real-time reporting. This allows for leaders to easily analyze key financial, statistical, and operational metrics that drive their decision-making. Headquartered in Ottawa, Canada, Multiview maintains sales and support operations throughout North America.